Affordable Living Apartments for Seniors

Why Affordable Senior Apartments Matter + Article Outline

Housing on a fixed income is more than a line item—it’s a foundation for health, independence, and everyday peace of mind. For many older adults, rent takes a large share of monthly resources, and when that share grows, everything else gets squeezed: groceries, preventive care, even small joys like a day trip or a class at the community center. Affordable apartments designed for seniors aim to rebalance that equation by aligning cost, access, and support. They do this through income-aware rents, age-friendly design, and a focus on stability. In plain terms, the right apartment can help stretch a dollar without shrinking your quality of life.

Affordable living for seniors matters for practical reasons and human ones. As mobility changes and social circles shift, a home that reduces strain—financially and physically—can mean the difference between thriving and just getting by. Many planners use a simple benchmark: try to keep housing costs at or below 30% of gross monthly income. That target is not a rule, but it’s a useful compass. The apartments discussed here work toward that direction through discounted rents, bundled utilities, and designs that reduce day-to-day effort.

Here’s the roadmap for this article so you can jump to what you need:

– Understanding affordability: how rents are set, what “cost burden” means, and how to build a realistic budget.

– Types of apartments: market-rate with senior-friendly pricing, income-restricted communities, and service-enriched options—plus what each typically includes.

– Finding and qualifying: where to search, what paperwork is commonly required, and how to navigate waitlists without frustration.

– Features that matter: accessibility, safety, transportation, and social programming that supports healthy aging.

– Conclusion and decision checklist: next steps to compare options and move forward confidently.

Think of this outline as your packing list before a short journey. Each section unpacks one small bag—costs, types, search strategies, features—so that by the end you can put together a home plan that feels practical, sustainable, and genuinely yours.

Understanding Affordability: Costs, Rent Models, and Budgeting

Affordability begins with clarity. Start by mapping your monthly income from retirement benefits, savings withdrawals, part-time work, or pensions. Then list essential housing expenses: rent, utilities, renter’s insurance, and internet if needed. Many households aim to keep total housing costs near 30% of gross monthly income; this is a widely used planning benchmark that helps preserve room for health needs, food, transportation, and recreation. While every situation differs, the benchmark offers a steady reference point as you compare apartments.

Rent models in senior-focused apartments typically fall into three broad categories. First, market-rate units that price competitively for the local area and may extend modest age-based discounts or include utilities. Second, income-restricted units that cap rents based on household income tiers, often resulting in noticeably lower monthly payments. Third, service-enriched communities where rent may be paired with optional add-ons such as meal plans or transportation, allowing you to customize support without paying for services you won’t use.

Don’t overlook “hidden” or periodic costs when you build your budget. Even affordable homes can strain finances if extras catch you off guard. Common items include:

– Utilities not bundled with rent, especially heating and cooling in extreme seasons.

– One-time application fees and security deposits, sometimes refundable.

– Laundry charges, parking, and pet fees where applicable.

– Occasional maintenance purchases like lightbulbs, filters, or shower mats.

– Transportation to medical appointments or grocery stores if not provided on-site.

Here’s a simple example to test your numbers. Suppose monthly income is 1,900. A target housing allocation at 30% would be 570. If an income-restricted unit lists rent at 520 and includes water and trash, you’d budget separately for electricity (say 50 to 80 depending on season), internet (around 40 to 60 if needed), and renter’s insurance (often 10 to 20 per month when averaged from annual premiums). This sketch adds up to roughly 620 to 680, a signal to review other expenses or look for buildings that bundle more utilities.

To stay on course over time, build a small buffer into your monthly plan for seasonal spikes and rate adjustments. Review statements quarterly to catch trends early. If you anticipate a change in income or medical costs, pencil in updates before they happen. The goal isn’t perfection; it’s a budget that guards your independence and keeps surprises from turning into setbacks.

Types of Affordable Senior Apartments and What They Offer

Senior apartments share a central aim—comfortable, sustainable living—but they differ in how they set rents and which amenities they include. Understanding the basic types helps you compare apples to apples. Broadly, you’ll encounter three models. Age-restricted, market-aligned apartments are designed for older adults and may offer reasonable pricing relative to local rents, often trading luxurious extras for practical comforts. Income-restricted communities adjust rents using household income thresholds, making monthly payments more predictable for many fixed-income residents. Service-enriched properties layer in optional supports—think meal programs, wellness checks, or local transit shuttles—so residents can choose the help that fits.

Eligibility varies across these models. Age-restricted units typically require at least one household member to meet a minimum age. Income-restricted communities verify household size and income during application and at periodic recertification. Service-enriched settings may use age and health-related criteria to tailor programming, although the apartments remain independent living rather than medical facilities. Keep a folder with identification, proof of income, and recent bank statements to speed up any eligibility review.

Features also differ, and thoughtful design can make daily life easier. Common elements include:

– Step-free entries, elevators, and wide doorways that accommodate walkers and wheelchairs.

– Grab bars, lever handles, and non-slip flooring to reduce fall risk.

– Bright, even lighting and lower cabinet heights for visibility and reach.

– Community rooms, gardens, or lounges that encourage social connection.

– On-site staff during business hours for maintenance requests and general support.

Amenities are important, but the most valuable features are the ones you will actually use. If you cook at home often, prioritize full kitchens with ample counter space and accessible storage. If you’re social, look for active calendars with game nights, workshops, or outings. If transportation is a concern, target properties near bus lines or with scheduled shuttles. For many, a modest apartment with sensible safety upgrades and a friendly courtyard beats a complex packed with amenities that drive up rent but gather dust.

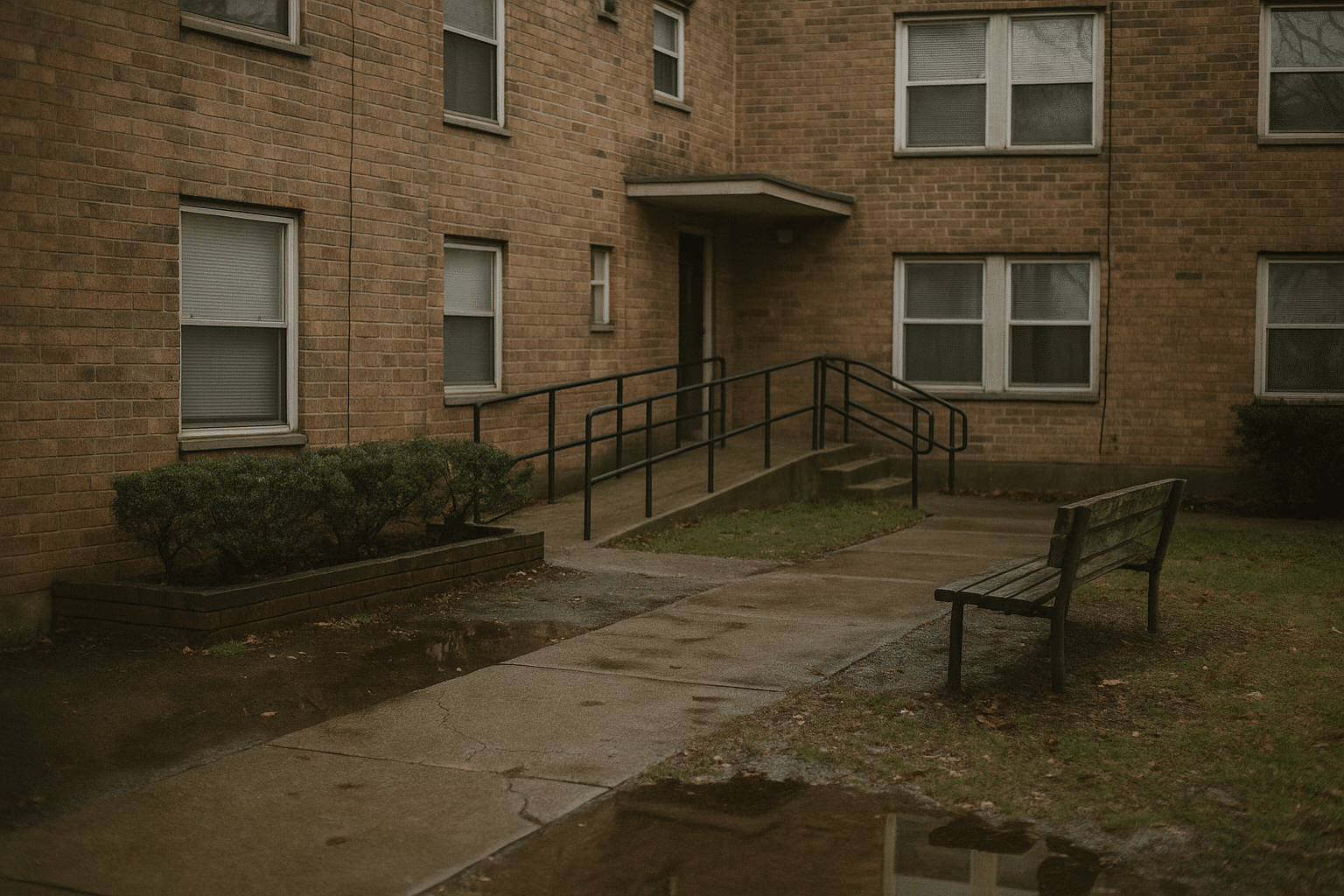

Finally, think about the neighborhood. Proximity to clinics, grocery stores, parks, libraries, and places of worship can quietly reduce monthly spending on rides and delivery fees. A calm block with sidewalks and benches may be worth more than a flashy fitness center. The right mix of apartment features and neighborhood assets can stretch both your budget and your energy in everyday, practical ways.

How to Find and Qualify: Search Strategies, Applications, and Waitlists

Start your search by casting a wide but focused net. Local housing authorities, nonprofit housing providers, senior centers, and state housing directories often maintain lists of age-restricted and income-restricted communities. Public libraries and community organizations can help you print applications or scan documents at little or no cost. If online forms feel overwhelming, many leasing offices will schedule a short appointment to walk through the process. Keep a simple spreadsheet or notebook to track where you applied, dates, contacts, and next steps.

To apply efficiently, assemble a “ready file.” Most communities request similar documents and will move faster when you have them at hand:

– Government-issued ID and proof of age for household members.

– Proof of income such as benefits letters, pension statements, or recent pay stubs.

– Recent bank statements and summaries of other assets, if any.

– Rental history and contact information for previous landlords.

– Authorization for background and credit checks, where applicable.

Screening is routine and usually aims to confirm stability rather than perfection. If your credit history is thin or includes old medical collections, consider adding a brief written explanation. Strong references from past landlords, consistent on-time utility payments, and a demonstrated history of caring for your home can all support your application. Ask whether application fees can be reduced or deferred in cases of financial hardship; policies vary, but it never hurts to inquire.

Waitlists are common in popular locations, and timelines vary widely by region and building size. You can improve your odds without straining your budget by:

– Expanding your search radius to nearby neighborhoods or towns with good transit links.

– Applying to multiple communities that meet your must-have criteria.

– Indicating flexibility on unit location (ground floor versus upper stories) if mobility allows.

– Responding quickly to requests for documents and update notices.

– Setting calendar reminders to check waitlist status every few months.

When you receive an offer, review the lease carefully. Confirm what utilities are included, how rent adjustments work at renewal, and any rules regarding guests, pets, or modifications like grab bars. If something is unclear, ask for a written explanation; clarity now prevents headaches later. With a calm, organized approach—steady search, tidy paperwork, and patient follow-through—you place yourself in a strong position to secure an apartment that fits both your budget and your goals.

Conclusion and Decision Checklist: From Searching to Settling In

Choosing an affordable apartment as an older adult is less about chasing deals and more about aligning what you need with what you can sustain. The right home safeguards your budget, preserves independence, and keeps you connected to people and services that matter. By understanding rent structures, preparing documents in advance, and focusing on features that lighten daily routines, you reduce uncertainty and increase your choices. What takes shape is not just a floor plan, but a life plan—rooms that support your habits, hallways that feel safe, and a neighborhood that invites you outside.

Use this decision checklist to compare options side by side and stay grounded during tours and calls:

– Budget fit: Total housing costs (rent plus utilities and insurance) near your target percentage of income.

– Access and safety: Step-free entry, grab bars, elevator, good lighting, and secure entries.

– Location: Walkability to groceries and parks, transit stops within reach, and short travel to medical providers.

– Community: Regular events you’d enjoy, quiet spaces for downtime, and friendly common areas.

– Policies: Clear language about renewals, guests, pets, and reasonable accommodation for unit modifications.

– Support: Optional services available if needed, without mandatory fees for programs you won’t use.

As you narrow the list, trust your observations. Listen for hallway noise, check water pressure, and note natural light at the time of day you’ll be home most. Ask residents, if appropriate, how maintenance responds and whether the building feels neighborly. Small details reveal how a place truly lives. If you find two strong contenders, revisit your priorities: is it the lower rent that frees up a little more each month, or the shorter walk to the clinic that saves energy all year?

Affordable living doesn’t have to feel like compromise. With a focused plan and a steady pace, you can move from scanning listings to settling into a home that respects your budget and supports your next chapter. The process takes patience, but the payoff is daily comfort: a door that opens easily, a chair by the window, and a community that says welcome every time you step outside.